After 2020 regional downturn, the International Monetary Fund (IMF) estimated the sub-Saharan Africa (SSA) economy grew at 3.7% in 2021 led by expansion in industry and services but still experienced weaker growth in gross fixed investment

A stronger recovery in global trade and surging commodity prices have revived growth in mining and export-oriented sectors.

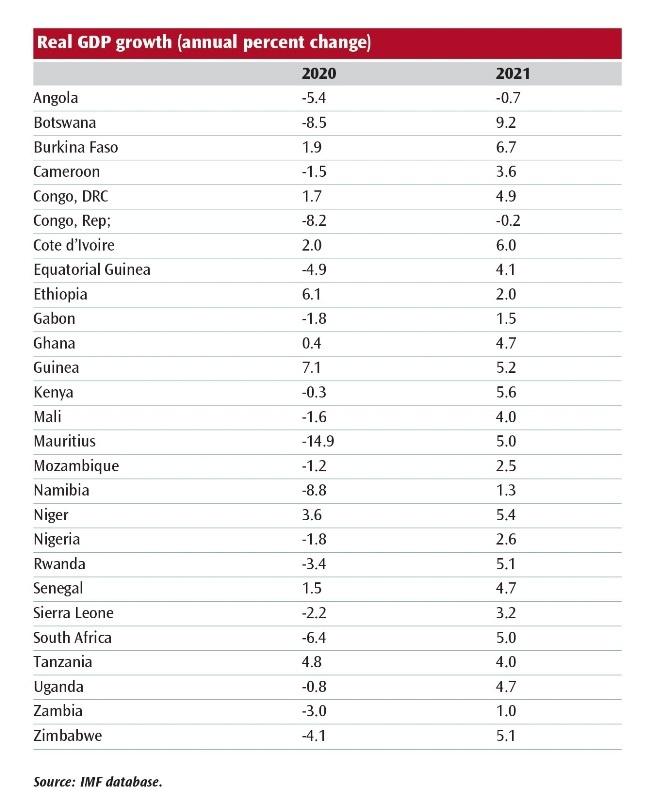

In 2021, only Angola, the Central Africa Republic; and the Republic of Congo; were in recession, i.e., negative GDP growth compared to 31 in 2020 (see Table).

Soaring metal prices (copper, cobalt, lead, manganese, nickel, zinc) and food commodities (coffee, sugar, wheat) have surpassed pre-pandemic levels. While oil prices are buoyant with demand rising faster than supply, but output (especially in West Africa) remains low. Rystad Energy projects West Africa crude production at 3.39mn-bpd this year, down from 4.12mn-bpd and 3.71mn-bpd, respectively, in 2019 and 2020. Weak jet fuel demand, reduced investment and security issues have affected mostly two largest producers (Nigeria and Angola).

Robust rebound in developing Asia (led by China) and most advanced (OECD) economies revived Africa’s key exports, foreign direct investment (FDI) and remittance inflows. FDI (which fell to US$30bn) in 2020, is expected to grow modestly in 2021-22, thanks to higher commodity demand, approval of priority infrastructure projects, and the finalisation of the African Continental Free Trade Area’s (ACFTA) Sustainable Investment Protocol. Regional remittances are expected to grow by 2.6% in 2021 after falling by 13.4% in 2020 (IMF data).

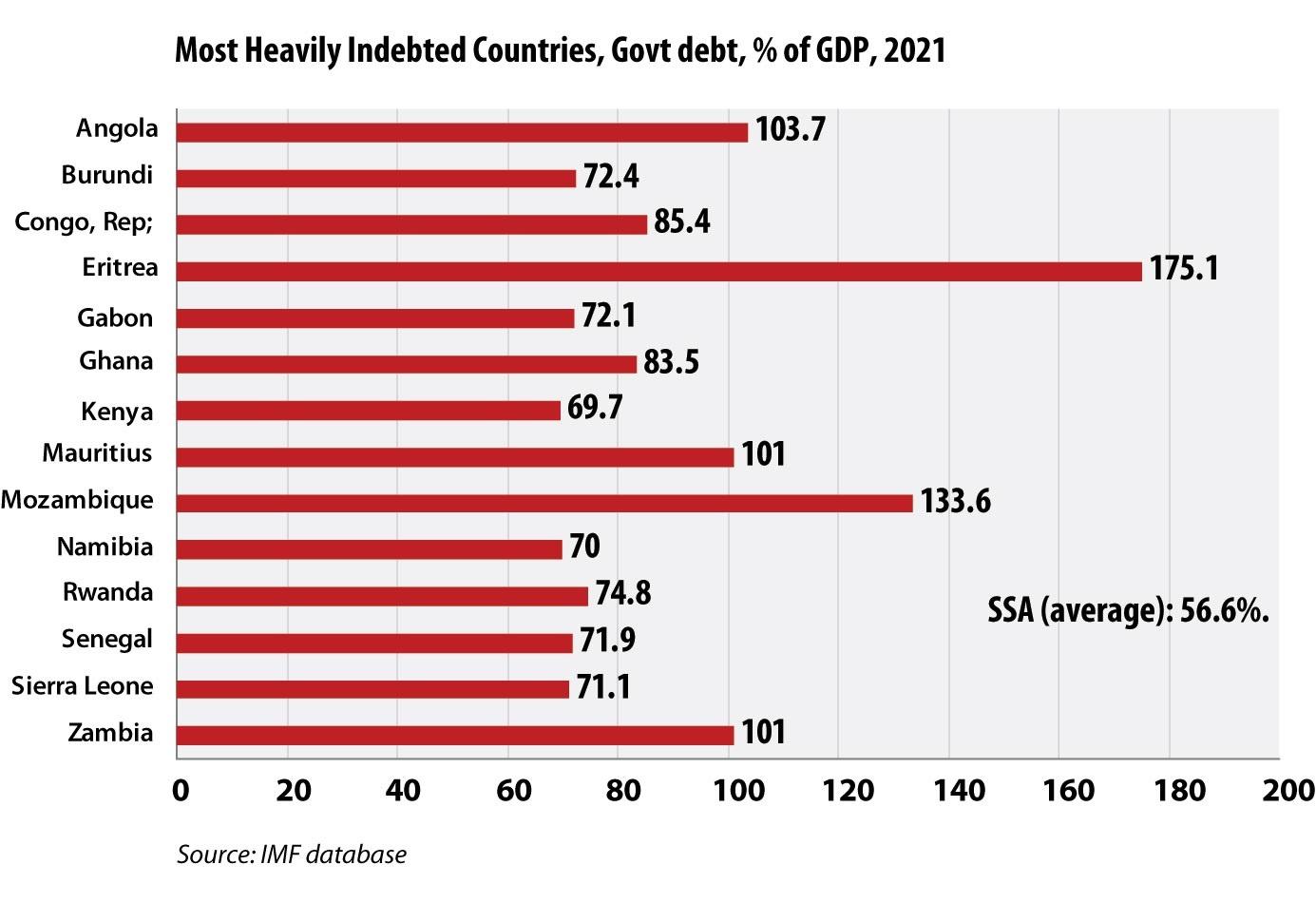

The Covid-19 downturn highlighted the region’s debt vulnerabilities with several countries reporting a steep increase in public debt, related to GDP (see Figure). Increasing reliance on commercial funding has raised the exposure of SSA frontier markets to interest rate, exchange rate, and rollover risks. As of Sep 2021, SSA-countries have raised US$13.2bn in Eurobonds (IMF data) – compared to US$5.9bn raised throughout 2020 - but costs remain higher than previous years.

The 2021 recovery masks noticeable diversity across country groups. Growth projections for oil-exporters are (2.2%) due to lower forecast for Angola; non-oil resource-intensive countries (4.7%), reflecting elevated metal prices; and non-resource-intensive countries (4.1%) mainly due to anaemic growth in Ethiopia. While for tourism-dependent countries (Cabo Verde, Comoros, The Gambia, Mauritius, São Tomé and Príncipe, Seychelles) - where travel/tourism constitute 18% of GDP on average – growth is expected at 4.5% or higher.

The 2021 recovery masks noticeable diversity across country groups. Growth projections for oil-exporters are (2.2%) due to lower forecast for Angola; non-oil resource-intensive countries (4.7%), reflecting elevated metal prices; and non-resource-intensive countries (4.1%) mainly due to anaemic growth in Ethiopia. While for tourism-dependent countries (Cabo Verde, Comoros, The Gambia, Mauritius, São Tomé and Príncipe, Seychelles) - where travel/tourism constitute 18% of GDP on average – growth is expected at 4.5% or higher.

On downside risk, the vaccine rollout in SSA has been the slowest in the world, leaving the region vulnerable to repeated waves of Covid-19.

External positions are expected to improve in resource-rich countries underpinned by rising commodity prices, although widening among non-resource countries. Last August, the Board of Governors of the IMF approved a general allocation of Special Drawing Rights (SDR) US$650bn to boost global liquidity. Of this amount, about US$24bn was allocated to SSA countries (3.7% of total) – major beneficiaries are Angola, Congo, DRC, Ghana, Nigeria, South Africa, Zambia, Cote d’Ivoire and Sudan.

Updates on Major SSA countries

•Nigeria’s economy (Africa’s largest) will grow by 2.6% in 2021, led by recovery in non-oil sectors and higher oil prices, even though crude production still remains below pre-Covid-19 levels. The IMF expects growth at under 3% level over the medium term, allowing GDP per capita to stabilise at current levels, notwithstanding deep-rooted structural problems and elevated uncertainties.

•South Africa is expected to grow by 5% in 2021, reflecting faster first-half recovery and strong base effects from 2020 to its national accounts. Economic activity faltered in second-half due to June lockdown for four weeks, plus social unrest in some provinces, causing an estimated R50bn losses. Pace of structural reforms to labour and product markets likely to remain sluggish – with real GDP growth slowing to 2.2% in 2022.

•Angola remains in prolonged recession, with elevated debt levels and rising inflation. The economy is expected to contract by 0.7% in 2021 – fifth consecutive year of recession – before returning to positive 2.4% growth in 2022 fuelled by higher oil prices. Its petroleum sector is affected by falling investments in new greenfield projects and recurring technical problems. Non-oil sector will remain key driver of economic growth, with commerce and agriculture likely to recover to above pre-pandemic levels in 2022-23.

•Economic activity in Kenya is projected to rebound from -0.3% growth in 2020 to 5.6% this year. The World Bank expects real GDP to grow at an average of 4.8% in 2022–23. This positive outlook reflects improvements in the construction, education, information and communication, and real estate sectors.

•Ghana is projected to register growth of, respectively, 4.7% and 6.2% in 2021 and 2022, underpinned by higher demand for its exports – mainly in the agriculture and industrial sectors. The economy proved quite resilient despite the outbreak of the Delta variant thanks to fiscal support to businesses. Ghana received the equivalent of US$1bn from the IMF, part of which was allocated for the Covid-19 Action Recovery and Economic Stimulus (CARES) programme.

•Côte d’Ivoire – largest member of the West Africa Economic Monetary Union (WAEMU) – is projected to expand at 6% and 6.5% in 2021 and 2022, respectively. The forecast reflects an increase in (public and private) investment, partly reflecting the political normalisation after peaceful and inclusive legislative elections, and ongoing efforts in the national reconciliation.

•Ethiopia’s decade of expansion averaging 9.3%/year (2011-20) plunged to just 2% this year. The Tigray conflict and slow pace of vaccination casts uncertainty over 2022 growth outlook. The country, however, undertook business-friendly reforms, chiefly liberalising the telecoms sector, which should attract more FDI contingent on political stability.

~Moin Siddiqi, economist.