The road ahead for entities supporting the recovery and development of Ebola-affected countries

The Ebola epidemic has undone a decade of economic progress in sub West Africa region, resulting in “incalculable” human and monetary losses in three core-affected countries: Guinea, Liberia and Sierra Leone, where the World Bank projects negative or contracting growth in 2015 under [high-Ebola] scenario, as they work with international partners to eradicate the virus.

Besides mournful losses in life, such evidence suggests that Ebola has manifested its impact on general economic activity through multiple channels, principally:

*The costs of reduced productivity due to significant falls in labour and capital utilisations. Reported decline in labour force participation - caused by fear, controls, and restrictions on movement - has reduced the productive capacity of the economy with many workers absent from workplaces over a longer period.

*The mining sector is singled out given its importance and the fact that its production and export volumes depend mainly on the presence of expatriates. Major iron ore producers such as London Mining and African Minerals in Sierra Leone and ArcelorMittal and China Union in Liberia have either scaled-back or shut down temporarily their operations - leading to reductions in national output. In three hardest hit countries, mineral exports fell sharply in the second-half of 2014. Weak iron ore prices are having adverse effects on exports and government revenues through lower royalty receipts, which are based on global commodity prices. Furthermore, restrictions on the movement of people have severely curtailed artisanal mining, including of gold and diamonds.

*Foreign direct investment (FDI) fell sharply because of heightened uncertainties about the future and interruptions to international travel and communication. In Liberia, investments to expand annual iron ore capacity at the largest mining company (ArcelorMittal) to 15mn tonnes are currently being put on-hold.

*Trade (or transactions) costs have risen over the past six months; such costs arise when goods are brought from the border for (imports) or from domestic suppliers to the border (for exports) and sales of domestic output domestically, respectively. High trade costs have led to spiraling consumer price inflation.

*External aid and grants from the bilateral-and multilateral donors to sub West Africa region have increased substantially since last summer, especially for purchases of goods/supplies, core logistics, training, and investment in rural health centers to contain Ebola. The World Bank is mobilising nearly US$1bn in financing for three worst hit economies. This includes US$518mn for the epidemic response, and at least $450mn from International Finance Corp (IFC); a member of the World Bank Group, in commercial financing to enable cross-border trade, investment, and employment in Guinea, Liberia, and Sierra Leone.

Motivation and participation

First are the direct and indirect effects having the sickness and mortality themselves, which increase the burden on healthcare resources and subtract people either temporarily or permanently from the labour force. Second and third are ‘behavioural effects’ arising from the fear of contagion that leads to a fear of association with others and reduces labour force participation, closes places of employment, disrupts transportation, motivates some governments to close land borders and restrict entry of citizens from afflicted countries, and motivates private businesses to disrupt trade, travel, and commerce by cancelling scheduled commercial flights and reducing shipping and cargo services.

The shocks to transaction costs (both domestic and international), to labour force participation, and to capital utilisation were reportedly worst in Liberia.

Immensurable costs

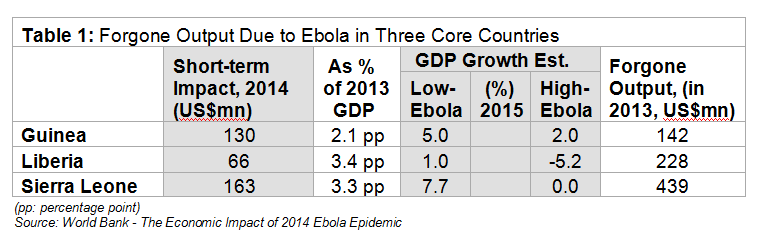

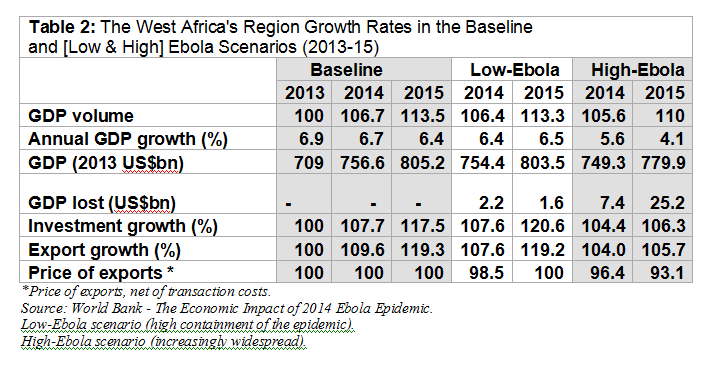

The World Bank’s latest projections imply forgone income across three worst-affected countries in 2014-15 totalling over US$2bn All three had been growing rapidly in recent years and into the first half of 2014. The forfeited gross domestic product (GDP) in 2015 amounts to between US$$129mn in Low-Ebola case and a striking US$815mn in High Ebola case (2013 dollars). Guinea, Liberia and Sierra Leone (together) account for about one-tenth of West Africa’s GDP.

Taking the two years together for West Africa region as a whole, the Bank estimates a moderate loss in GDP volume in [Low Ebola case] of US$3.8bn and in [high-Ebola case] a substantial US$32.6bn by the end of 2015. That is 4.1 per cent of what regional GDP would have been in the absence of Ebola in 2014. This is an enormous cost, not only for the most affected countries, but also for the wider region. It has the potential to be deeply destabilising and requires an immediate international response. “While there are signs of progress, as long as the epidemic continues, the human and economic impact will only grow more devastating,” warns Jim Yong Kim, President of the World Bank Group.

The Bank’s report finds that total fiscal impact in 2014 alone exceeded US$500mn, which imposed additional budget needs of six, three, and 2.5 percent of GDP, respectively, in Liberia, Guinea and Sierra Leone. Governments have had to cut public capital expenditures by more than US$160mn, hurting future growth prospects. Fiscal deficits need to widen to enable the countries to accommodate higher Ebola-related spending and to help avoid an even more pronounced decline in economic activity. But there remain further large financing gaps for 2015, more support from the donor community is urgent to assist these countries cope with human tragedies and improve their public health systems, thereby building up resilience and preparedness for potential future outbreaks.

The way forward

*Militate against ‘aversion behaviour’: the magnitude of estimated impacts suggests the need over time for a concerted action plan to help core three countries in post-Ebola economic rehabilitation, thus returning their respective economies to robust growth, and abating negative perceptions that can harm the sub-region even after the situation on the ground has improved. The real danger is that adverse sentiment leads to a dramatic closure of business at a time when these fledgling countries desperately need higher levels of FDI and foreign trade.

Jin-Yong Cai, IFC CEO, explained, "The fear swirling around Ebola has the potential to do long-term harm to businesses globally, and especially in the Ebola-affected countries. IFC will find and create opportunities to encourage private investors to play a large role in the recovery of markets directly and indirectly affected by the ongoing Ebola outbreak in West Africa.”

*Fiscal support: Critically needed strong growth in hardest-hit countries over the medium-term is becoming elusive. Increased external assistance will enable respective governments to continue functioning and providing services as they and their partners seek to eradicate the epidemic. The fiscal gap, just for 2014, was estimated at around US$290mn. The estimates of immediate humanitarian costs from the United Nations and the World Health Organisation have been revised upward, from US$495mn to US$600mn.

*The monetary costs can be limited if swift national and international responses succeed in containing the epidemic and bring back investors (notably mining companies), whilst mitigating the ‘fear factor’ resulting from people’s concerns about contagion, which could fuel steep economic downturn across the region. Marcelo Giugale, Senior Director of the Macroeconomics and Fiscal Management Global Practice at the World Bank said, “A full-fledged recovery effort could help the affected countries improve on growth estimates, and return to building their economies and reducing poverty.”

*Restoring global confidence: A key issue in post-crisis period is re-establishing investor support so that as the epidemic is contained, domestic and foreign investments can return. There is an urgent need for policies to encourage commercial exchange (for business, trade and eventually tourism purposes) with the sub-region, while also safeguarding partners from epidemiological contagion. This, in turn, requires funding to improve health security infrastructure and to seaport and airport protocols in the three countries and their neighbours.

Looking ahead, the memory of 2014 havoc must be sustained with continuous emphasis on expanded disease surveillance, diagnostic, and treatment capacity facilities after Ebola outbreak has been contained. The international community should act on the knowledge that decrepit public health infrastructure, institutions, and systems in many African countries are equally a threat to their own citizens, trading partners and global economy at large. “The Ebola outbreak has laid bare the failure of any reasoning that investments in public health infrastructure, institutions, and systems can be separated from investments in economic recovery and development. Building the infrastructure, institutions, and systems necessary to prevent future outbreaks (of Ebola or other pathogens) confers benefits that are non-rival and non-excludable,” urged the World Bank.

Moin Siddiqi