According to Stanbic IBTC Bank, July’s PMI survey signaled the sharpest overall improvement of business conditions in the Nigerian private sector for two years, as the economy extended the upturn seen throughout 2017

The latest growth rise has stemmed from steep expansions in output and new orders, both of which were at 24 and 25-month highs respectively. Job creation was at its strongest in a year, although employment growth remained marginal overall. On the price front, input and output price inflation remained below their historical averages despite rising slightly in the latest survey.

The main findings of the July survey were as follows: Output grew sharply in July, indicated by the rate of expansion hitting a two-year high. Many of the Nigerian panelists noted strong customer demand as a key factor behind the latest increase.

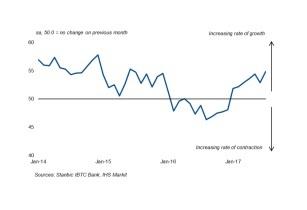

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below display a deterioration.

At 54.8 in July, the headline PMI rose above June’s reading of 52.9 indicating a strong start to the third quarter of 2017. Furthermore, the latest survey signaled the sharpest expansion in the Nigerian private sector since July 2015.

The level of new orders received by Nigerian private sector firms increased at the sharpest rate in 25 months in July. Anecdotal evidence pointed towards stronger domestic demand for Nigerian-produced goods and services compared to that seen in export markets. This was signaled by a fall in the level of new orders from abroad in July.

Input price inflation was at a four-month during the latest survey period. The rate at which average cost burdens in the Nigerian private sector increased was solid overall. Anecdotal evidence pointed towards rising raw material costs as a primary cause.

Output charge inflation rose in July, ending the sequence of softening output price inflation seen over the previous seven months. The rate of inflation was solid overall, albeit below the historical average.

To support rising output requirements faced by firms operating in the Nigerian private sector, job creation was at a 12-month high in July. However, the rate of growth was only slight overall and remained below the survey’s long-run average.

Backlogs of work increased at the fastest rate for 20 months in July. Anecdotal evidence suggested capacity shortages at Nigerian private sector firms. Finally, there was sharp growth in buying activity during the latest survey period, as firms responded to rising production requirements.