IEA reveal oil demand, supply and stock information in eagerly awaited report

• The Euro zone debt crisis influenced market sentiment in October and early November although ultimately fundamentals reasserted themselves. Futures prices for benchmark crudes diverged in October, with WTI on a solid upward trend while Brent eased. At writing, Brent traded around $114/bbl, with WTI at $96/bbl.

• Forecast global oil demand is revised down by 70 kb/d for 2011 and by 20 kb/d for 2012, with lower‐than‐expected 3Q11 readings in the US, China and Japan. Gasoil continues to provide the greatest impetus for demand growth. Global oil demand is expected to rise to 89.2 mb/d in 2011 (+0.9 mb/d y‐o‐y) and reach 90.5 mb/d (+1.3 mb/d) in 2012.

• Global oil supply rose by 1.0 mb/d to 89.3 mb/d in October from September, driven by recovering non‐OPEC output. A yearly comparison shows similar growth, with OPEC supplies well above year‐ago levels. Non‐OPEC supply growth averages 0.1 mb/d in 2011 but rebounds to 1.1 mb/d in 2012, with strong gains from the Americas.

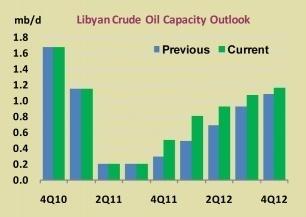

• OPEC supply rose by 95 kb/d to 30.01 mb/d in October, with higher output from Libya, Saudi Arabia and Angola, partially offset by lower output from other members. The ‘call on OPEC crude and stock change’ for 2011 is largely unchanged at 30.5 mb/d, while higher non‐OPEC supply leads to a 0.2 mb/d downward adjustment for 2012 to 30.4 mb/d.

• Global refinery crude throughputs fell sharply in September, as planned and unplanned shutdowns amplified the normal seasonal downturn. Following significant refinery outages and apparent delays in starting up new capacity in Asia, 3Q11 global runs have been lowered by 30 kb/d, to 75.5 mb/d, while 4Q11 runs are revised down 260 kb/d, to 75.1 mb/d.

• OECD industry oil stocks declined by 11.8 mb to 2 684 mb in September, led lower by crude, plus lesser declines in middle distillates and fuel oil. Inventories stood below the five‐year average for a third consecutive month, a first since 2004. September forward demand cover dropped to 57.9 days, from 58.6 days in August. October preliminary data point to a 34.3 mb draw in OECD industry stocks.