Page 2 of 2Possible reversal in investor sentiment

Thanks to ample global liquidity and ultra-low US interest rates, an increasing number of African countries have tapped capital markets; concurrently, the outstanding stock of Eurobonds has grown almost fourfold over past five years. Sovereign bond issuances rose from US$6.5bn in 2013 to US$8.7bn in 2014, with maiden issuances by Côte d’Ivoire, Ethiopia, and Kenya. Following a period when they remained low/stable, emerging and frontier market spreads, have risen significantly in the first-half of 2015.Evidence suggests that investors are discriminating more carefully among SSA markets, with spreads increasing more sharply in some countries.

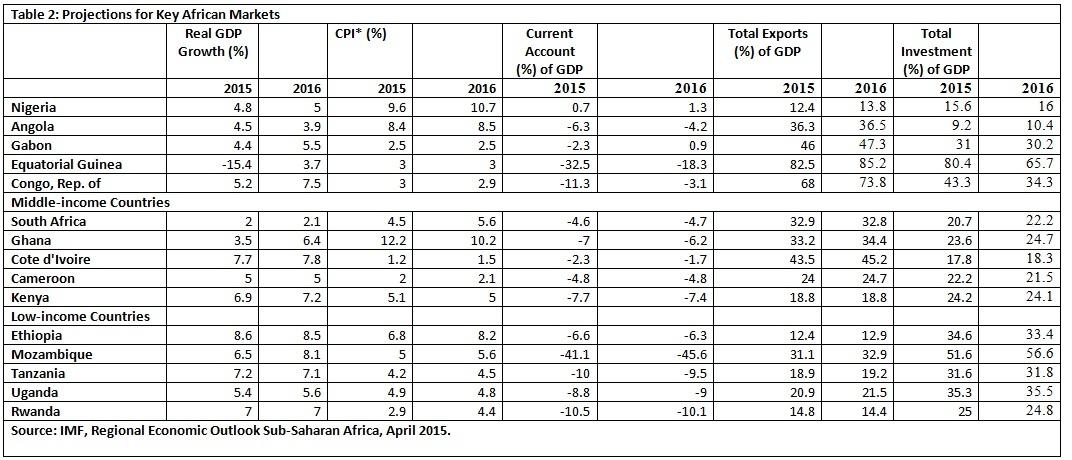

Therefore, yields on the region’s bonds are trending up, especially in Ghana (owing to galloping fiscal-external deficits), Zambia (impacted by low copper prices), Gabon and Nigeria (the oil shock). The interest rate on Cote d’Ivoire’s US$1bn Eurobond issue in February 2015 was almost 100 basis points higher than its first issue in October 2014.

Given the probability of tightening global financial conditions alongside limited funding opportunities in domestic/regional markets, capital-raising may suddenly become difficult or borrowing costs may surge. The imminent normalisation of US monetary policy (i.e. a gradual lifting of quantitative easing by the Federal Reserve Board) would prompt a broader reassessment of emerging market risk. Should this risk materialises and financing costs increase sharply, those African governments planning Eurobond issues should reconsider their plans advised the IMF, though, such financing is critical to addressing public investment needs of buoyant frontier markets.

Depreciation of national currencies increases the cost of servicing international bonds. “Quite a few sovereigns and more so corporates have borrowed in dollar-denominated loans, which are creating a difficulty there. They have to keep a tight ship and try to really be very cautious with their public spending,” noted the IMF.

Looking ahead

The resource-rich countries would benefit from encouraging more rapid economic diversification by addressing chronic infrastructural bottlenecks to private sector activity (including by small and medium-sized enterprises) and improving their business environment, where most African countries rank low in the World Bank/IFC annual Doing Business surveys. The World Bank puts it, “The end of the commodity super-cycle has provided a window of opportunity to push ahead with the next wave of structural reforms and make Africa’s growth more effective at reducing poverty.”Achieving sustained, robust, and inclusive growth remains the overarching priority for the region. That, in turn, demands building solid infrastructures to create jobs, fulfilling social needs of a growing population in the midst of a demographic transition and expanding trade with both developing and developed world, whilst integrating successfully into global value chains.

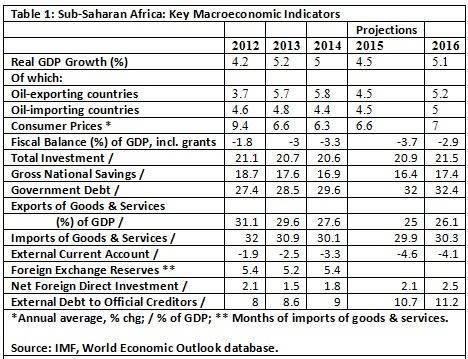

In sum, SSA’s growth over the medium-term is projected to exceed peer developing regions (Chart2). Investors have benefited over years from higher returns in diverse sectors as energy, mining, ITC, tourism and manufacturing.

Moin Siddiqi, economist